Table of Contents

What does banking of the future look like? For many financial institutions, digital transformation is shifting banks to the cloud and driving the adoption of emerging technologies. This move to a digital-first model is all about optimizing data, compliance, and technology to make holistic improvements to the security, agility, operational efficiency, and customer experience of financial services.

We’ve compiled the key trends and best practices for digital transformation in banking, as well as some core technologies, strategies, and challenges to note when completing these projects.

What Is Digital Transformation and IT Modernization in the Banking Sector?

Digital transformation in banking refers to the integration of digital technologies across operations, including core business processes, customer service, and compliance. When banks engage in digital transformation, they can keep up with evolving customer needs, maintain their competitive advantage in the financial sector, and better meet regulatory standards.

Digital transformation efforts create a large-scale impact, often shifting entire business models, domains, or cultures. Due to the wide scope of these initiatives, many organizations use a phased approach, focusing on specific components like cloud adoption or digital product development before advancing.

IT modernization is a foundational step in digital transformation that involves updating or replacing outdated technology, such as banking systems, infrastructure, or applications. Some key parts of IT modernization can include updating applications and infrastructure, incorporating more automation, and completing a cloud migration project.

Today, digital transformation and IT modernization in banking enable capabilities such as online banking, cloud computing, artificial intelligence and machine learning (AI/ML), mobile banking, and big data analytics.

Why is Digital Transformation Important for Banks?

Digital transformation is important for banks for a few reasons. From a customer-facing perspective, digital transformation projects matter because end users are used to a certain quality of experience. For example, mobile apps have become the norm. According to the American Bankers Association, two-thirds of millennial and Gen Z customers choose mobile banking as their most-used banking method. Customers expect convenience and ease of use when interacting with businesses in any industry. Completing banking tasks should be just as easy as shopping online.

Additionally, digital initiatives are a driving force for innovation, creating new revenue streams, cutting costs, and attracting top IT talent to a once-traditional industry.

Digital transformation in financial services is also important for protecting banks. Cybercrime continues to be one of the top 10 global threats to the economy, according to the World Economic Forum, and financial institutions are a major target for cybercriminals due to the value and sensitivity of financial data. Strengthening security and compliance with advanced capabilities, like automated threat detection, is vital for all banking entities.

It’s not uncommon for industries like banking to rely on legacy systems for key business processes since they can be hard to update and migrate to the cloud. However, failing to do so can give competitors the edge. Digital transformation is the next step for many banking organizations in remaining financially viable and setting their institution apart.

Altogether, digital transformation can help organizations achieve measurable outcomes such as faster customer onboarding, reduced fraud losses, lower operational costs, and improved customer trust.

What Are the Key Drivers of Digital Transformation in Banking?

The key drivers for digital transformation in banking include meeting customer expectations, satisfying compliance demands, keeping up with the latest technologies, and implementing projects with an eye on the competitive landscape.

Customer Expectations

User expectations have changed dramatically in recent years. Digital check deposits and robust mobile banking weren’t always the norm, but now, a seamless virtual experience is simply the baseline. Today’s customers are looking for a mobile-first, omnichannel, and personalized experience that provides access to the information that’s most vital to them upfront. Fulfilling this need empowers banks to achieve higher retention rates, customer satisfaction, and Net Promoter Scores (NPS).

Data analytics and generative AI can help deliver efficient, tailor-made experiences for end users. Banks are rapidly exploring GenAI copilots of advisors, AI in risk modeling, document processing, and regulatory reporting that can all appeal to customers seeking trust,personalization, and optimized returns.

Uptime and resiliency are also critical. Customers expect 24/7 banking and perpetual access to make payments and access claims. These expectations also align with customer standards around security. 91% of Americans decide which bank to use based on fraud protection and other security features. This places it as the most important factor, on equal footing with quality customer service and digital banking access, increasing the urgency of IT transformation.

Security and Compliance Demands

According to IBM’s 2025 Cost of a Data Breach report, the financial industry experiences the second-most expensive breaches, averaging $5.56 million. While this number decreased from 2024 ($6.08 million), cyber threats still pose a significant danger to financial services companies.

To manage risks, banks need to follow relevant data privacy frameworks and industry-specific regulations. Digital transformation can support compliance with:

- Payment Card Industry Data Security Standard (PCI DSS): All companies that process, accept, transmit, and store credit card information need to do so in a secure environment.

- Sarbanes-Oxley Act (SOX): Public companies need to satisfy strict reporting and auditing requirements. This is done to fight corporate fraud.

- General Data Protection Regulation (GDPR): An EU-based regulation that has established rules around the collection, processing, and storage of EU citizen data.

- Bank Secrecy Act (BSA): A United States-based law that requires financial institutions to help government agencies prevent and identify instances of money laundering.

Adopting the right technologies can help financial institutions avoid millions of dollars in breach costs, legal expenses, and noncompliance penalties.

Technological Advancements

New technologies are opening opportunities in financial products, banking services, and risk management. Digital transformation projects can reshape and elevate traditional processes.

For example, a cloud-first institution can unlock capabilities such as:

- Real-time data analytics

- Scalable infrastructure

- Secure and compliant storage

- Process automation

- Faster fraud detection

- Personalized customer services

- Predictive analytics to proactively flag risks or serve as virtual advisors for self-directed investors

Competitive Landscape

Agile FinTech startups are poised to disrupt the financial services industry. These new companies aren’t overburdened by legacy systems, which allows them to develop and launch digital-first, innovative products more quickly. Traditional banks need to reduce their IT complexity and increase their agility to keep up.

The need for core banking modernization and new revenue streams, such as robo-advisors or peer-to-peer payments, is rapidly driving digital transformation. Open banking, which lets financial institutions collaborate with FinTech companies and integrate their capabilities, also proving the value of agile, connected operations. When banks embrace this form of digital transformation, they can achieve faster time to market and new revenue streams.

Core Technologies Powering IT Transformation

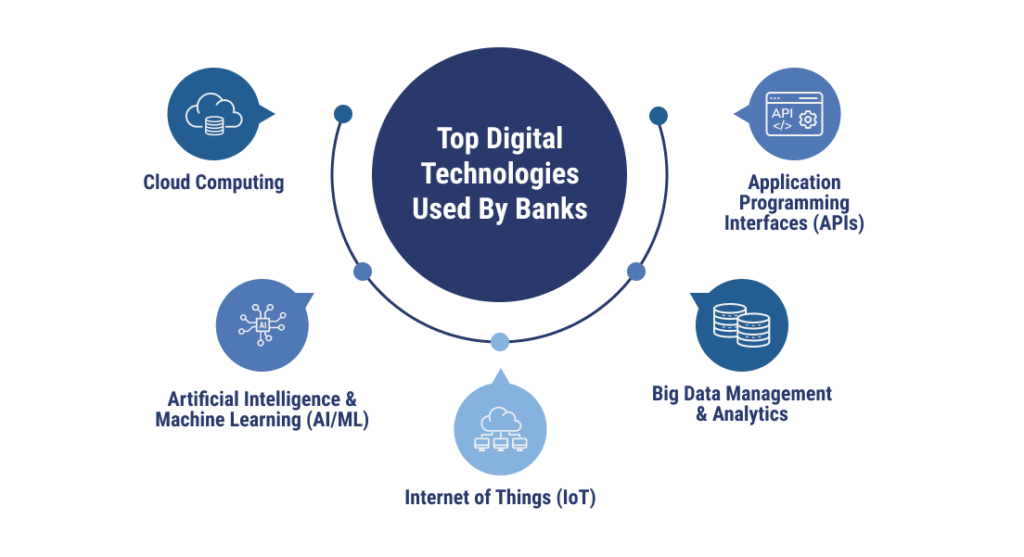

The banks that are ahead of the pack with their digital transformation strategy are employing technologies such as cloud computing, artificial intelligence, big data management, and APIs to meet and exceed customer expectations, as well as improve their internal operations.

Cloud Computing

Shifting to cloud computing is often one of the first steps an organization takes as part of their digital transformation journey. Traditional, on-premises infrastructure can be inflexible and difficult to modernize. Cloud migration allows organizations to take advantage of cloud-first and cloud-native applications that are easier to manage and update.

Cloud computing also offers more options and resources compared to traditional frameworks. Cloud-powered banks achieve 47% greater resilience and decision-making compared to their non-cloud-powered competitors.

Cloud computing can be used to:

- Modernize core banking systems, improving performance and enabling new products to launch more quickly

- Switch to Infrastructure as a Service (IaaS), reducing the reliance on physical hardware

- Support disaster recovery efforts, ensuring financial institutions can restore services quickly during an outage

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning (AI/ML) can play a role in many different parts of your organization. Generative AI, as demonstrated by large language models and tools like ChatGPT, can personalize customer experiences by using preferences and use cases to deliver more relevant solutions. AI/ML can also automate repetitive tasks or uncover previously unseen patterns.

Some use cases for AI/ML can include:

- Fraud detection, identifying behaviors before they can be spotted by humans

- Predictive analytics, forecasting with greater accuracy and precision based on training from previous large datasets

- AI-powered chatbots that can serve as customer self-service tools

Internet of Things

The Internet of Things (IoT) is all about connecting physical objects to the internet. These innovative technologies include smart ATMs, which include predictive maintenance and facial recognition capabilities, and onsite branch sensors that analyze foot traffic and queue times to optimize staffing and customer service efforts. When supported by edge computing, which brings processing power closer to end users, IoT can be an especially powerful tool.

Big Data Management and Analytics

Digital transformation projects often improve the ability to collect and see a larger quantity of data produced by a bank. This creates opportunities for big data analytics, which could be done through cloud monitoring tools, business intelligence (BI) software, or other integrated solutions. When used well, customer data analysis can:

- Illuminate paths to new products and online services

- Identify areas for improvement in banking processes

- Reveal security and compliance vulnerabilities

Application Programming Interfaces (APIs)

Application programming interfaces (APIs) serve as the connectors between back-end technologies and front-end systems. With APIs, financial institutions can improve the digital experience without completely overhauling their current systems by adding third-party functionality. For example, banks can connect their digital platforms with FinTech platforms, software as a service (SaaS) tools, virtual currencies, and other modern technologies to offer new features.

Two applications for this powerful tool include:

- Integrating with third-party apps for budgeting, payment services, etc.

- Embedding financial products into non-financial applications (e.g. buy now, pay later functionalities)

Banks leveraging these technologies see measurable outcomes, including accelerated loan processing times, reduced fraud exposure, and personalized digital experiences that drive loyalty and revenue growth.

Digital Identity and Biometric Authentication

Digital identity and biometric authentication enable highly secure, seamless, and fully remote customer interactions.

Biometrics such as fingerprint and facial recognition can replace cumbersome passwords for account access, loan applications, and more, delivering a frictionless and cost-effective experience. At BBVA, biometric technology can verify identities in a matter of seconds by checking against IDs and passports from over 190 countries, speeding up onboarding times.

These unique identifiers can also offer stronger protection against fraud and identity theft. This helps banks meet rising regulatory demands for stronger customer authentication around the world.

Strategies for Implementing Digital Transformation

Implementing digital transformation in banking can be a substantial task, but breaking the effort into steps can make the ship feel easier to turn.

Define Your Digital Transformation Objectives

Before starting a digital transformation process, financial institutions need to understand their goals. What are you looking to achieve by implementing these projects? For example, if you’re migrating to the cloud, are you looking to reduce downtime by 30% or launch new digital products 2x faster? The objectives should align with the focus areas for your digital strategy and provide metrics for assessing whether the efforts are successful.

Assess Your IT Environment

Next, it’s time to evaluate your current IT environment. This includes any existing hardware, software, or infrastructure you own and operate. It also includes your technical debt. Ask yourself – has your organization taken shortcuts that will cost more to fix down the line if you try to make legacy systems work? Identify them and what it might take to improve them for more sustainable, long-term opportunities for innovation and success.

Develop a Digital Transformation Roadmap

Once you understand where you are and where you’d like to be, it’s time to build a digital transformation roadmap. This plan should prioritize initiatives based on how they will impact the business and how feasible they are to complete. Once priorities are set, you can allocate resources and build timelines with milestones.

Even with the most detailed, thought-out plan, keep in mind that unexpected factors will arise. Consider this roadmap as a living document that can change as you progress and learn more.

Build a Solid Cybersecurity Framework

Ample security measures are essential to derisking digital transformation in banking. However, the growing IT skills gap means there needs to be enough runway in your timelines to resolve any talent needs required to safely adopt new digital tools and infrastructure.

Top cybersecurity concerns across industries include data loss prevention, firewalls, antivirus safeguards, and cloud security. Whether it’s with your team or a managed IT security services provider, develop a cybersecurity framework that’s built with the cloud and other emerging technologies in mind.

Learn more about building and managing cloud security from Sameer Airyil, Executive Director of Cloud and Cybersecurity at JPMorgan Chase, on Ep. 29 of TierPoint’s Cloud Currents podcast:

Foster a Culture of Continuous Innovation

In the face of constant change, it’s important for teams to be focused on continuous improvement. Digital transformation is as much a cultural shift as it is a technical and procedural one.

One way banks can foster an innovative culture is by having software development and IT operations join forces on a DevOps team. Using DevOps best practices can help financial institutions develop software more efficiently and effectively. DevOps teams work to automate development, version software through gradual changes, and collaborate regularly throughout the process. Banks that employ DevOps best practices can remove the silos between teams and develop software with greater accuracy, speed, and cost-efficiency.

Organizations may also want to implement Agile methodologies. These approaches break projects into smaller, more manageable tasks, focus on continuous feedback loops to make adjustments incrementally, and encourage cross-functional teams to work together closely. For example, in a DevOps setup. Agile methodologies can reduce the risk by encouraging the launch of minimum viable products (MVPs) and evolving constantly.

Common IT Transformation Challenges in Financial Services

When banking and financial services organizations start digital transformation projects, they can experience challenges with modernizing legacy systems, securing data throughout the process, avoiding organizational silos, and overcoming skill gaps.

Legacy System Modernization

You want to move off of legacy systems, but you can’t risk disrupting operations. Any disruptions can shake trust and result in significant lost revenue. Does this situation sound familiar? Banking institutions can counter these challenges with gradual, phased migrations, or by implementing APIs that integrate modern services.

A mid-sized financial services company experienced similar challenges, relying on TierPoint to migrate to AWS and continue managed services post-migration. Our phased migration approach minimized disruptions, and now, the client benefits from continuous optimization and 24/7 monitoring.

Data Privacy and Security Concerns

New technologies bring new opportunities, but they also introduce new vulnerabilities. Ransomware, phishing, data breaches, and other financial services cybersecurity threats can be more likely when an organization increases its attack surface.

A robust cybersecurity framework is necessary to properly address data privacy, security, and compliance concerns. One of TierPoint’s financial services clients came to us while using a hosted VMware private cloud, knowing that they would need something different to improve compliance transparency and manage their infrastructure more proactively. We helped them move to a modern, compliant AWS foundation that prioritized governance while leveraging automation and ongoing support.

A similar move banking organizations may want to consider is employing secure virtual desktops, such as Azure Virtual Desktop, to protect sensitive data while enabling hybrid work for advisors and analysts. While the data and applications are hosted securely in the cloud, users can access critical applications and information from anywhere, on any device.

Organizational Silos

Digital transformation can feel like it’s all about technology and implementing new procedures, but it’s also about changing the culture at an organization to embrace change. Financial organizations can operate in silos, where different departments work on their own goals without much cross-communication. When there isn’t strong collaboration between teams, transformation efforts can stall or stop. This leads to less-than-ideal customer experiences and half-completed projects.

Financial institutions need to foster a collaborative culture internally to combat this. Leadership should have a clear vision for what they want to accomplish with digital transformation and how they want to see departments work together. There should be cheerleaders at different points of the organization that can advocate for change and participate more significantly in transformation and cloud migration projects. Leaders may even want to implement incentives for achieving key transformational milestones.

Skills Gaps

The skills that are necessary to thrive in on-premises environments are not the same as those that will equal success in the cloud. According to a recent McKinsey survey, 88% of bank executives believe that the biggest obstacle in the way of delivering a “successful cloud program” is a deficit of cloud talent. Instead of hiring new talent, it’s often a more cost-effective measure for financial institutions to bring in IT service providers to fill in any gaps.

Accelerate Your Digital Modernization with an Experienced IT Service Provider

The banking industry is moving at warp speed, but solid digital modernization efforts can’t be rushed. It’s important to have the right experience on your side for effective digital transformation.

TierPoint can help you reduce cloud migration risks, reduce downtime, and deliver expected outcomes to your internal teams and external customers. Risk reduction also comes from our compliance strength; we can help banking clients meet all necessary industry regulations, such as PCI DSS, while keeping one eye on future innovations.

Regardless of where you’re at in your IT modernization journey (or where you want to go), we can help. We are cloud-agnostic and can take your workloads across Azure, AWS, and other providers without vendor lock-in. Our experts are ready to deliver a long-term roadmap for transformation, not just a one-time project.

FAQs

Organizations may choose to focus their digital transformation on business domain, business model, business process, or cloud transformation. Some may also cite a fifth focus area, which involves cultural or organizational transformation.

In any digital transformation process, it’s important to remember the 3 Ps, which are people, process, and platform. All these components are crucial to a successful digital strategy.

When organizations in the banking industry embark on digital transformation projects, they can improve productivity, innovate more efficiently, improve the customer experience, expedite decision-making, and boost the security of their systems.

Table of Contents

-

Artificial Intelligence (AI)

Feb 11, 2026 | by Mikael Grondahl

Top Trends for AI in Data Management in 2026

VIEW MORE -

Cloud

Jan 19, 2026 | by Matt Pacheco

IT Trends Report: Hybrid, AI, and Security Investments Accelerate Through 2030

VIEW MORE -

Cloud

Jan 8, 2026 | by Matt Pacheco

What Is Cloud TCO? How to Calculate Total Cost of Ownership

VIEW MORE