Industry Pressures Reshaping IT Financial Services

Personalization and easy access to financial services are now the expectation all customers hold. Current technologies, including AI and big data management, enable organizations to offer new financial IT services to customers. However, these services can’t get off the ground with outdated infrastructure, underutilized data, or technology that doesn’t meet security and compliance standards.

Technology Shift for Financial Services

The Financial services industry is looking to the cloud to enhance current business operations, resiliency, compliance, and prepare them for the future. Public cloud adoption is accelerating, with 61% of financial services companies shifting at least half of their applications to the cloud.

Artificial intelligence will factor heavily into this digital transformation. The World Economic Forum and Accenture estimate that AI spending in financial services will surge from $35 billion in 2023 to approximately $97 billion by 2027, demonstrating the sector’s accelerating commitment to AI-driven transformation. The same report highlights that around 70% of financial services executives believe AI will directly contribute to revenue growth in coming years.

Security Threats Challenge Financial Services

What We Do

TierPoint helps financial institutions modernize IT to keep pace with evolving expectations, security risks, and regulatory demands. Our managed services team serves as an extension of your staff, freeing your internal teams to focus on growth while we handle the complex, time-consuming tasks. We provide strategic IT guidance and have experience in diverse skill sets, including cybersecurity, disaster recovery, and cloud services. With TierPoint, you gain the agility, security, and resilience needed to turn industry pressures into competitive advantage.

How We Digitally Transform Financial Services

Transform Financial Services with the Cloud

With the right tools and IT infrastructure, financial services organizations can harness cloud capabilities to deliver an improved customer experience. A stronger emphasis on data and analytics can help organizations make more informed and efficient business decisions. All while helping create a more personalized experience for end users. Don’t let legacy systems hold you back.

Cloud technology can also support a hybrid workforce that can maintain top talent and improve employee satisfaction.

Balance Security and Transformation Initiatives

Technology decisions can affect strategic, regulatory, operational, financial, and risk to your reputation. Digital transformation can allow you to deliver engaging customer experiences and valuable insight. However, financial information also needs to be kept secure at all times.

Your customers expect an experience that is fast, frictionless, and amenable to self-service. Financial services organizations need to answer the call and grow while protecting valuable data.

Simplify and Optimize for IT Growth

Mergers and acquisitions (M&A) and growth over time can lead to IT infrastructure being pieced together from disparate and disconnected systems. You may find yourself investing significantly in legacy infrastructure that is keeping you from evolving. An IT overhaul can improve business performance and drive efficiencies. Your institution should be able to spend less time on administration and maintenance, leaving more time to focus on innovative services that can engage customers and drive revenue.

Transform your infrastructure with secure, compliant cloud solutions tailored for the finance industry.

Capabilities

-

Cloud Services

Run your critical applications where they perform best, without compromising compliance, security, or customer trust. With TierPoint, you gain a full spectrum of cloud choices across AWS, Azure, Azure Local, Azure VMware Solution, and VMware, spanning public, private, and hybrid options. Our experts help ensure your workloads align with your regulatory obligations and application needs, so you stay agile, resilient, and always in control.

Learn more -

Security and Compliance

Protecting your data, revenue, and reputation starts with a proactive defense against evolving threats. With the TierPoint Adapt Platform, you gain AI-powered protection and 24/7 expert response that help stop risks before they disrupt your business. Our layered approach spans detection, prevention, and compliance, so you can defend against breaches and fraud while meeting rigorous standards like PCI, SOC 2, and ISO 27001. The result: stronger security, continuous compliance, and the confidence to focus on growth.

Learn more -

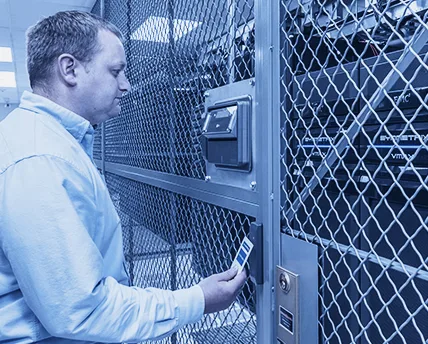

Data Center and Colocation

Every transaction, customer interaction, and trading decision depends on resilient infrastructure you can trust. Gain secure, scalable colocation across 40 state-of-the-art facilities nationwide, delivering the space, power, and connectivity you need to keep operations running without interruption. TierPoint's carrier-neutral data centers combine redundant systems, low-latency connectivity, and rigorous physical security with the compliance certifications financial institutions demand. And with seamless integration to a vast ecosystem of carriers and cloud providers, you gain the assurance, flexibility, and performance to safeguard trust and ensure business continuity.

Learn more -

Recovery and Backup

Downtime or data loss can put customer trust and regulatory compliance at risk. TierPoint gives you confidence with secure, scalable backup and disaster recovery solutions designed for financial services. From public to private to hybrid cloud failover, you gain flexible recovery options that protect critical applications and ensure business continuity, so you stay resilient against cyberattacks, outages, or unexpected disruptions.

Learn more

Certified. Compliant. Trusted.

Meeting the highest standards in data security and compliance.

SOC 2 + HITRUST

Compliant

ISO27001-2022

Certified

PCI DSS

Certified

Finance Success Stories

Our Satisfied Customers

Still have questions?

Let’s discuss how our financial industry expertise can help your business accelerate IT transformation, improve customer experience and unlock new revenue streams.