Hosting workloads in the cloud can feel almost limitless. Businesses that were once constrained to on-premises frameworks can achieve greater scalability, agility, and innovation potential after cloud migration. However, cloud spend can also feel limitless, easily getting out of control without the right framework in place. Organizations should look to cloud financial management (CFM) strategies to optimize their cloud finances and get the most out of their cloud environments without going overboard.

What is Cloud Financial Management?

Cloud financial management is a comprehensive approach to managing your finances in the cloud that covers many different aspects. Businesses that engage in cloud financial management will do so to improve cost visibility and transparency, cut down on unnecessary usage, improve their budgeting and forecasting capabilities, and form guidelines for automated financial controls.

Cloud Financial Management vs. Cloud Cost Optimization: What’s the Difference?

Cloud financial management and cloud cost optimization are closely related, but not identical. Most of the difference has to do with the focus and scope. Cloud cost optimization is mainly concerned with techniques that optimize costs, such as right-sizing resources and taking advantage of pricing models that result in the most cost savings. Cloud financial management, on the other hand, encompasses cloud cost optimization alongside broader strategies, such as budgeting, forecasting, and developing policies.

The Importance of Efficient Financial Management in Cloud Services

Efficient cloud financial management can prevent cloud waste, maximize ROI, lead to more informed financial decisions, improve transparency around cloud spend, and support business agility and greater innovation.

By gaining more visibility on your cloud spend and creating guardrails around financial management and cloud use, you can reduce your cloud costs, allocate spend more effectively, and reserve more of your budget for product and service development, or other more strategically focused initiatives.

Essential Elements of Cloud Financial Management

The foundation of successful financial management in the cloud relies on a few essential elements, including cost allocation, cloud optimization, and reporting to identify successes and new opportunities.

Cost Allocation and Budgeting

It’s easier to manage your cloud finances once you can accurately track and allocate cloud service costs across business units, departments, or projects. Getting more specific with your cost allocation and cloud budget can help you reduce your bill over time. Use historic spend to build a realistic budget plan and use forecasting tools to anticipate future resource needs.

Cost Optimization and Savings

Use previous cloud usage data to find areas for cost optimization, which could include right-sizing resources, negotiating new pricing with cloud providers, or adding more reserved instances for predictable workloads.

Cloud Financial Management

While this may feel redundant, cloud financial management also refers to an advanced approach that uses data analytics and automation tools to gain deeper insights on cloud financials. This approach can help organizations gain more control over their cloud finances.

Reporting

Reporting can include tools that offer real-time visibility into cloud spending with multiple filters to see where spend is concentrated, as well as retrospective tools that illustrate trends and highlight anomalies. Both reporting methods can help businesses make proactive cost management moves.

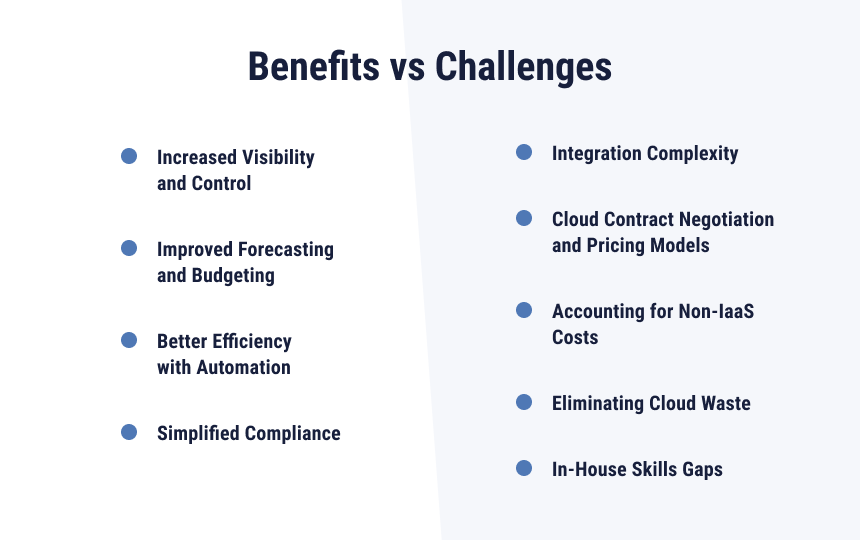

Cloud Financial Management Benefits & Challenges

Engaging in cloud financial management can be hugely beneficial to your business, but it also comes with challenges you’ll need to overcome to make the most of your cloud environment.

Benefits

- Increased visibility and control: Cloud costs tend to creep up over time, largely due to a lack of oversight. Creating a cloud financial management framework will increase the visibility on your cloud spend and help you find opportunities to control this spend. Having a dedicated team or personnel proactively managing and monitoring cloud usage allows for proactive identification of unnecessary spend and enforcement of financial discipline within the cloud environment.

- Improved forecasting and budgeting: Being intentional about cloud financial management means that you are bringing a greater focus on previous cloud usage and financial data that will enable you to forecast and budget more accurately in future years.

- Better efficiency with automation: Creating automated rulesets can prevent unexpected spikes in spend and provide instant feedback to departments and other organizational divisions.

- Simplified compliance: A cloud financial management tool can help businesses adhere to financial regulations and internal policies around cloud spending without having to repeatedly go back to the drawing board.

Challenges

- Integration complexity: Some environments may be more ready to integrate with cloud financial management tools than others. Legacy frameworks will require more configuration and may not fully integrate with cloud-first or cloud-native tools.

- Cloud contract negotiation and pricing models: Different cloud providers offer different contracts and pricing models for their cloud resources. Understanding your options based on pricing, and negotiating effectively, requires background knowledge and time to weigh your options.

- Accounting for non-IaaS costs: It’s easy to think about cloud finances in terms of infrastructure as a service (IaaS). However, there are many other costs associated with the cloud, including software as a service (SaaS), platform as a service (PaaS), and data storage fees.

- Eliminating cloud waste: Identifying and getting rid of cloud waste isn’t a one-time project. It needs to be part of a regular maintenance task to manage finances most effectively.

- In-house skill gaps: An in-house team will need to know what a “good” spend is in the cloud to implement cloud financial management measures effectively. Businesses will either need to have someone on staff with experience in cloud cost management, financial management, and data analysis, or they may need to rely on outside help.

Strategies for Effective Cloud Financial Management

Challenges shouldn’t stop businesses from implementing cloud financial management. They should simply serve as a list of things to look out for on your way to building an effective strategy.

Optimize Resource Allocation and Usage

Right-sizing, reserved and spot instances, and automated scaling can all help you optimize your resource allocation and usage. Regularly survey your cloud usage to decide whether you need to scale your resource up or down to fit your needs. This keeps you from paying more than what you’re actually using.

Reserved instances offer pricing at a significant discount for predictable workloads. For more savings, businesses can use spot instances for workloads that are more variable and can afford to be interrupted.

Once you understand your typical capacity range, autoscaling policies can help your business adjust resources up and down based on preset thresholds. Autoscaling can increase capacity in peak times, as well as cut down on overprovisioning in quiet times.

Utilize Cloud Financial Tools and Solutions

Most major cloud providers have some kind of cloud financial management tools. For example, AWS Cloud Cost Financial Management and Azure Cost Management feature recommendations for reserved instances, cost allocation tools, and anomaly detection services. Businesses that have a multicloud or hybrid cloud environment can also use third-party CFM solutions for better integration or necessary features.

The right financial tools should help you better understand what factors most influence your cloud spending, also known as cloud economics. From there, you can make more informed decisions and optimize your spend more wisely.

Incorporate AI/ML

Certain artificial intelligence (AI) and machine learning (ML) tools can identify patterns, pinpoint anomalies, and create automations that build on a foundational cloud financial management approach. Because of the real-time nature and faster processing of AI/ML tools, businesses can often make financial decisions with greater speed and accuracy when they implement these technologies.

Establish Governance Policies

Automated solutions and financial management tools should be used in accordance with clear guidelines and limitations outlined in a cloud financial governance policy.

Ensure that everyone is on the same page before implementing these tools by gathering input and developing a policy that promotes accountability and cuts down on uncontrolled spend. Creating a FinOps team, a partnership between IT and finance teams, can also be a good way to develop and carry out an effective cloud financial policy.

The policy may also dictate which individuals and groups are able to access certain controls that can provision additional resources if necessary.

How to Take a Strategic Approach to Cloud Financial Management

Taking a strategic approach to financial management starts by fostering a collaborative environment, involving the right teams to create a financial policy, and using the right tools to automate much of the cost optimization. If your team needs support with developing a cloud financial management approach, TierPoint’s cloud consultants can help. Contact us today to learn more. In the meantime, download our whitepaper to discover how to boost ROI by utilizing top cloud cost optimization strategies.